- 21 June 2023

- By atomedya

- Bookkeeping

Content

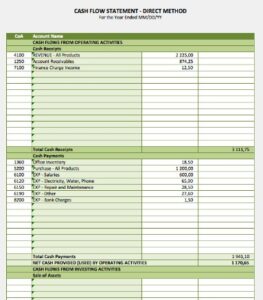

Now that you are aware that your business cannot survive without proper cash flow management, it becomes crucial to manage it effectively, and this is where automation plays a pivotal role. Now that you have learned how to read a cash flow statement, let’s delve into the process of preparing one. The Cash Flow Statement Direct Method takes all cash collections from operating activities and subtracts all of the cash disbursements from the operating activities to get the net income. Profit, however, is the money you have after deducting your business expenses from overall revenue. This cash flow statement shows Company A started the year with approximately $10.75 billion in cash and equivalents.

- When the cash flow from financing is a positive number, it means there is more money coming into the company than flowing out.

- When you summarize all cash transactions, you can get a positive or a negative cash flow.

- In business strategy, these financial statements can illuminate where a company is overspending and inform changes to the company’s overall approach.

- So, any changes in assets, equipment, or investments that relate to cash from investing.

- When you have a positive number at the bottom of your statement, you’ve got positive cash flow for the month.

When there is an increase in liabilities, there is also an increase in cash flow. While the P&L and Balance Sheet are critical to understanding your financial health, they in themselves do not show the true impacts of cash. Not all sales provide cash to the bank on the same day of the sale – for example, A/R and Third-Party Delivery Services. Operators can utilize the cash flow statement both internally and externally. Your cash flow, on the other hand, only shows how much actual cash you have. You need to adjust your earnings so you only have actual cash in your operations section.

Is the Presentation Representative of Actual Cash Inflows and Outflows?

Working capital represents the difference between a company’s current assets and current liabilities. Any changes in current assets (other than cash) and current liabilities (other than debt) affect the cash balance in operating activities. Investing activities include cash flows from the acquisition and disposal of long-term assets and other investments not included in cash equivalents. For instance, purchasing or selling physical property, such as real estate or vehicles, and non-physical property, like patents. The cash flow statement serves as a crucial tool for assessing a company’s financial health and liquidity. It goes beyond mere profit figures, revealing the true cash-generating capabilities of a business.

If you’re a business owner or entrepreneur, it can help you understand business performance and adjust key initiatives or strategies. If you’re a manager, it can help you more effectively manage budgets, oversee your team, and develop closer relationships with leadership—ultimately allowing you to play a larger role within your organization. Cash obtained or paid back from capital fundraising efforts, such as equity or debt, is listed here, as are loans taken out or paid back. Get up and running with free payroll setup, and enjoy free expert support. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

The three sections of a cash flow statement

Unlevered free cash flow shows you cash flow before financial obligations while levered free cash flow explains cash flow after taking into account all bills and obligations. The operations section on the cash flow statement begins with recording net earnings, which are obtained from the net income field on the company’s income statement. After this, it lists non-cash items involving operational activities and convert them into cash items. A business’ cash flow statement should show adequate positive cash flow for its operational activities. If it doesn’t, the business may find it difficult to manage its daily business operations. While positive cash flows within this section can be considered good, investors would prefer companies that generate cash flow from business operations—not through investing and financing activities.

To download the example cash flow statement used throughout this post, click here. In this article, we’ll go through the basics of a cash flow statement, the information it contains, and how cash flow is calculated. We’ll also go through a real-world example of how you can read and use the information from a cash flow statement.

Global E-Invoicing and Payment Software

Cash flow analysis helps your finance team better manage cash inflow and cash outflow, ensuring that there will be enough money to run—and grow—the business. Operating activities include the production, sales and delivery of the company’s product as well as collecting payment from its customers. This could include purchasing raw materials, building inventory, advertising, and shipping the product. International Accounting Standard 3 specifies the cash flows and adjustments to be included under each of the major activity categories. This is the cash flow statement for XYZ company at the end of Financial Year (FY) 2018.

- This type of analysis may uncover unexpected problems, or it may show a healthy operating cash flow.

- Under Cash Flow from Investing Activities, we reverse those investments, removing the cash on hand.

- Simply put, your restaurant cash flow is profits made minus all operating costs.

- Keep in mind, positive cash flow isn’t always a good thing in the long term.

- For instance, purchasing or selling physical property, such as real estate or vehicles, and non-physical property, like patents.

- When your cash flow statement shows a negative number at the bottom, that means you lost cash during the accounting period—you have negative cash flow.

- Essentially, a cash flow statement is a financial statement that provides a comprehensive overview of a company’s cash inflows and outflows during a specified period.

And, if you buy something from a supplier on credit, you will not include it on your cash flow statement until you pay it. Cash flow statements only record when you actually have the money at your business or when the money actually leaves your business. Generally, a company is considered to be in “good shape” if it consistently brings in more cash than it spends. Cash flow reflects a company’s financial health, and its ability to pay its bills and other liabilities. The bottom line on the statement is the Net Increase (Decrease) in Cash and Cash Equivalents.

Drive Business Performance With Datarails

A cash flow statement is an important tool used to manage finances by tracking the cash flow for an organization. This statement is one of the three key reports (with the income statement and the balance sheet) that help in determining https://kelleysbookkeeping.com/ a company’s performance. It is usually helpful for making cash forecast to enable short term planning. Cash flow statements are also helpful for investors to see how much money their companies are making (or losing).

Look for consistent levels of cash flow from Operating Activities over time, indicating the company will probably continue to be able to fund its operations. This is quite a forensic exercise that will essentially require you to look over every line account used in your accounting software. Once analyzed, a discussion with the financial controller, or CFO, can then take place to question any discrepancies of opinion over the correct classification of items.

In general, companies strive to achieve a positive cash flow for their business. Net income adjusted for non-cash items such as depreciation expenses and cash provided for operating assets and liabilities. Using a free public template from the Small Business Administration (SBA), let’s say Wild Bill’s Dog Trainers and Walkers had a net income of $100,000 to start and generated additional cash inflows of $220,000. That bottom line is calculated by adding the money received from the sale of assets, paying back loans or selling stock and subtracting money spent to buy assets, stock or loans outstanding.

- This section of the statement shows how much cash is generated from a company’s core products or services.

- Rather than showing every single transaction in a formal report, the statement of cash flows summarizes these transactions.

- For example, if a company buys new computers for its employees, that would be recorded as an investment expense.

The problem with the Income Statement is that it includes many non-cash allocations, accounting conventions, accruals and reserves that have nothing to do with cash. To determine if a company’s net income What Is The Purpose Of The Cash Flow Statement? is of “high quality”, compare the Net Cash Provided by Operating Activities to the Net Income. The Net Cash Provided by Operating Activities should be consistently (over time) greater than the Net Income.

The statement also reveals the sources and uses of certain cash flows, which would not otherwise be readily apparent to the reader. These line items include changes in each of the current asset accounts, as well as the amount of income taxes paid. The restaurant cash flow statement records incoming and outgoing cash over a defined period of time, typically a quarter or fiscal year. Investors and lenders want to make sure they won’t lose money from your business. The cash flow statement shows them that your business is generating enough money to pay off your expenses, including loans and investments. The financing section of the cash flow statement looks at how your company pays back lenders and investors.

- Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

- The Acme Manufacturing Consolidated Statement of Cash Flows does not include Supplemental Information.

- The insights garnered from a cash flow statement play a pivotal role in aiding management’s decision-making process, allowing for the regulation of business operations based on well-informed judgments.

- The cash flow statement takes that monthly expense and reverses it—so you see how much cash you have on hand in reality, not how much you’ve spent in theory.